WEALTHCARE

Did you know that a retired couple is likely to experience one spouse living into their nineties? They will spend a small fortune on food and health care, live mainly on a fixed income and face a loss of their purchasing power each and every year.

Also consider that psychological studies show that an investor may weigh the impact of a capital loss 2.5 times more heavily than a capital gain. This same investor may not fully appreciate that an asset that loses 50% of its value requires a 100% investment return just to climb back to break-even. Worse yet, our natural "fight-or-flight" instinct can compel us to divest a distressed investment asset at the most inopportune time.

The point is that financial success is often predicated on smart planning and objective decision-making. It is also true that it is human nature to make emotional and sometimes faulty financial decisions when left to our own devices. The consequence may be outliving your money, making unintended lifestyle sacrifices or even taking unnecessary financial risks.

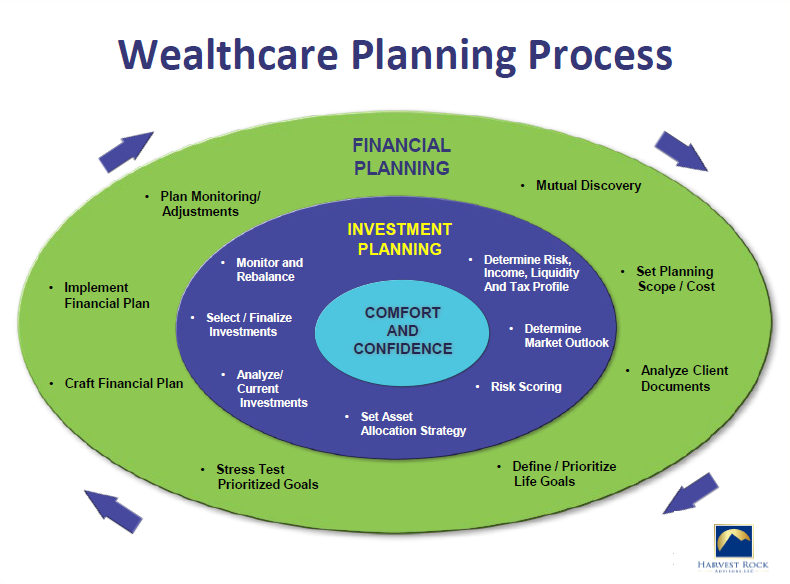

The good news is that some negative financial outcomes may be avoided through smart financial planning. Our wealth management process, Wealthcare, can help you prioritize your most valued life goals - short, medium and long-term - and help you rise to the challenge of reaching them with confidence.

The foundation of Wealthcare planning is discovering your most valued goals and organizing them in their priority value. Once your prioritized goals are established, they are stress-tested to determine the appropriate blend of strategy and tactics to pursue them with a higher level of confidence.

The stress-test ensures your goals are matched to your financial resources, lifestyle, obligations, tax profile and other factors to increase the likelihood of a successful outcome.

Moreover, our wealth planning designs the right investment strategy that squares with your resources, goals and tolerance for investment risk.

Once designed, the planning model produces your personalized "Comfort Zone", the space where your wealth plan and investments should meet in balance. We can help you maintain your wealth plan on the proper path, recommending corrections as necessary to keep you in your Comfort Zone over time.

The bottom line is that effective wealth planning can help you make smarter life decisions, deal with present challenges and prepare to live the fullest life possible with more confidence, grounded in effective risk management.

Making financial decisions focused on your goals can be a satisfying experience. It is the essence of Wealthcare and we would welcome the opportunity to introduce it to you. |